Mutual Funds

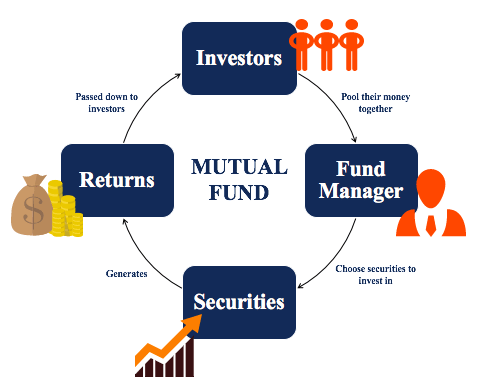

Mutual Funds are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of assets, including stocks, bonds, and other securities. Managed by professional fund managers, mutual funds provide a way for individuals to access a broader range of investments than they might be able to on their own.

When you invest in a mutual fund, you are essentially buying shares in that fund. The value of these shares, known as the Net Asset Value (NAV), fluctuates based on the performance of the fund’s underlying assets. Mutual funds charge fees, typically including an expense ratio and sometimes sales fees, which cover management and operational costs.

- Equity Funds: Focus on stocks for potential growth.

- Bond Funds: Invest in bonds, providing regular income with lower risk.

- Balanced Funds: Combine stocks and bonds to offer a mix of growth and income.

- Index Funds: Track a specific market index, like the S&P 500, for a low-cost investment.