Our Services

Financial Planning

A financial plan can provide financial guidance so you’re prepared to meet your obligations and objectives. It can also help you track your progress throughout the years toward financial well-being.

Wealth Management

Wealth management is an investment advisory service that uses financial services to address the needs of affluent clients.This service is usually appropriate for wealthy individuals with a broad array of diverse needs.

Business Loan

Business Loan you can make informed decisions and secure the financing needed to support your business goals. Every business needs constant capital to ensure expansion and long-term sustainability.

Life Insurance

Life insurance is an essential part of a comprehensive financial plan.

Understanding how life insurance works and find the best coverage to meet your family’s needs.

General Insurance

General Insurance company protects your valuable assets from fire, theft, burglary, or any other unfortunate accident.General Insurance covers only sudden, accidental and unforeseen losses, not gradual wear and tear or predictable events.

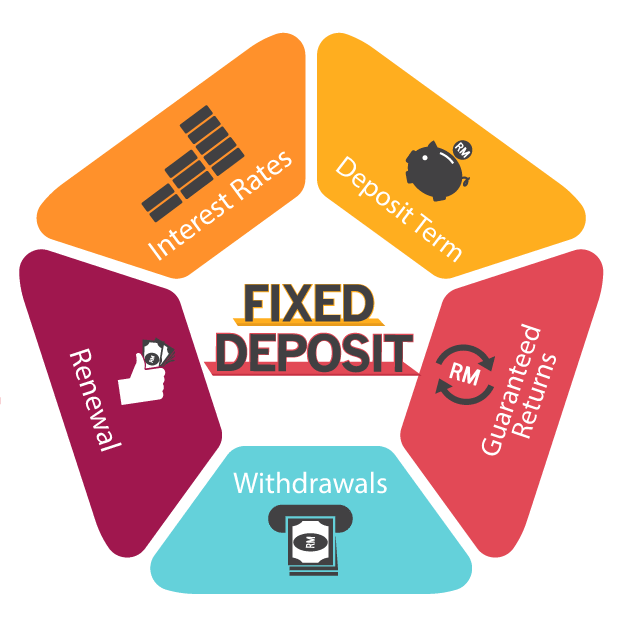

Fixed Deposits

Fixed Deposits (FDs) are a popular financial investment option offered by banks and financial institutions. In an FD, an individual deposits a lump sum amount with the bank for a fixed period at a predetermined interest rate.

TRUST

For clear, dependable financial solutions that provide peace of mind for all your needs, rely on KSfintech.

FINANCIAL FREEDOM

Count on our experience to clear your path to financial independence, ensuring progress, self-assurance, and tranquility on your future travels.

WE'RE CREATIVE

creating creative financial solutions that are specifically suited to your goals and supported by knowledgeable advice.

HONEST

Where integrity and openness coexist, providing our clients with reliable guidance and assistance.

Why Choose Us

We have been assisting customers with money management for more than 10 years. Whatever your objectives, we can design a unique strategy to help you get there. Investing, retirement planning, or simply managing your money. We have the knowledge you need. Since every person’s circumstances are different, we take the time to listen to you and create a plan that works for you. Our committed team provides a potent blend of new ideas and experience. We prioritize your well-being and think that enduring relationships should be founded on honesty and trust. Not only will you receive financial services, but you’ll also have a reliable counselor at your side.We do more than just process transactions. We provide you the ability to take charge of your financial destiny.Making wise decisions today that result in a better financial future is what we’ll help you with through individualized advice, proactive planning, and continuous support. Let us assist you as you pursue financial success.

- Superior Dedication

- Credit Resources

- Advance Cash

Our Achievements

Happy Customers

Dedicated Staff

Funding From Banks

Years of Experience

We're Providing Best Finance Solutions For Your Company

Over 10 Years of Financial Support Experience

We’ve been a reliable source of financial help for 12 years. This period has taught us a lot. Come learn with us from our combined 12+ years of financial experience. We have encountered difficulties as well as possibilities. We always work to adjust to market developments. Our path has been one of perseverance, experimentation, and assisting our clients in realizing their goals. We invite you to accompany us as we continue on our path to achievement.

- Secured Loans

- Credit Resources

- Advance Cash

Our Cases

What We Have Done

Taxation

Taxes come in various forms and can be imposed at the federal, state, or local levels. Without taxes, governments would struggle to provide the essential services that benefit society as a whole. by which a government imposes financial obligations on individuals, businesses, and other entities.

Accounting

It communicates critical information to stakeholders such as management, investors, creditors, and regulatory bodies. The accuracy and clarity of financial information are paramount, which is why businesses rely heavily on accounting practices.

CFO

The Chief Financial Officer (CFO) is the senior executive responsible for managing the financial actions of a company. The role is essential for ensuring that a company’s financial statements are accurate, taxes are managed properly, and that the organization meets its financial goals.

Request A Call-Back

Get The Estimate

Loan Calculator Information

The Equipment Finance Calculator calculates the type of repayment required, at the frequency requested, in respect of the loan parameters entered, namely amount, term and interest rate. The Product selected determines the default interest rate for personal loan product. The Equipment Finance Calculator also calculates the time saved to pay off the loan and the amount of interest saved based on an additional input from the customer. This is if repayments are increased by the entered amount of extra contribution per repayment period. This feature is only enabled for the products that support an extra repayment. The calculations are done at the repayment frequency entered, in respect of the original loan parameters entered, namely amount, annual interest rate and term in years.Calculator Assumptions

Length of Month

All months are assumed to be of equal length. In reality, many loans accrue on a daily basis leading to a varying number of days interest dependent on the number of days in the particular month.Number of Weeks or Fortnights in a Year

One year is assumed to contain exactly 52 weeks or 26 fortnights. This implicitly assumes that a year has 364 days rather than the actual 365 or 366.Rounding of Amount of Each Repayment

In practice, repayments are rounded to at least the nearer cent. However the calculator uses the unrounded repayment to derive the amount of interest payable at points along the graph and in total over the full term of the loan. This assumption allows for a smooth graph and equal repayment amounts. Note that the final repayment after the increase in repayment amount.Rounding of Time Saved

The time saved is presented as a number of years and months, fortnights or weeks, based on the repayment frequency selected. It assumes the potential partial last repayment when calculating the savings.Amount of Interest Saved

This amount can only be approximated from the amount of time saved and based on the original loan details.Calculator Disclaimer

The results from this calculator should be used as an indication only. Results do not represent either quotes or pre-qualifications for the product. Individual institutions apply different formulas. Information such as interest rates quoted and default figures used in the assumptions are subject to change.

Finance Calculator

| Period | Payment | Interest | Balance |

|---|

Application fee

₹500

Monthly fee

₹10

Total regular fees

₹1440

Total fees

₹1940

Calculator Disclaimer

The repayment amount shown using this calculator is an estimate, based on information you have provided. It is provided for illustrative purposes only and actual repayment amounts may vary. To find out actual repayment amounts, contact us. This calculation does not constitute a quote, loan approval, agreement or advice by My Finance. It does not take into account your personal or financial circumstances.